Why Audit-Ready Carbon Projects Protect Compliance and Reputation

Carbon Neutral

DateOctober 2025

The climate landscape in Australia is shifting rapidly. As the safeguard mechanism evolves and emissions compliance becomes more stringent, major emitters – mining giants, energy producers and global manufacturers – find their carbon management decisions under unprecedented scrutiny. For mandatory compliance, the trustworthiness of carbon credits is not an abstract concern but a boardroom imperative. Each Australian Carbon Credit Unit (ACCU) becomes an emblem of both climate action and corporate integrity, with the power to fortify – or undermine – reputation, compliance and value.

In this environment, businesses can no longer afford to approach carbon project engagement as a transactional obligation. The risks are too high, the stakes too visible and the market too discerning. What’s needed is an unwavering commitment to carbon integrity – a principle that sits at the heart of Carbon Neutral’s philosophy and project delivery.

Safeguarding Corporate Reputation

Many see carbon auditing as a bureaucratic exercise; a compulsory hurdle to clear before project certification. But this mindset overlooks the true purpose of rigorous validation: to anchor trust at every stage of the project process. For Carbon Neutral, auditing is not an afterthought – it is a defining feature of our project blueprint.

We recognise that our clients measure value by the security and credibility of their offsets. An ACCU is more than evidence of abatement; it is a financial asset, a compliance lever and often the public face of a company’s climate ambition. Yet none of these attributes matter if the underlying offset cannot withstand independent and public scrutiny.

That’s why our teams move beyond standard procedures:

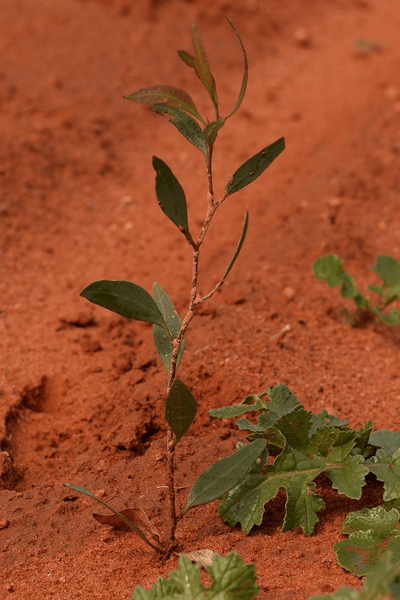

- Ground-level measurement: Employees are present in the field, undertaking meticulous ecosystem monitoring, tree measurement and data recording. These activities generate datasets that speak to genuine environmental transformation, not simply intention.

- Transparent evidence trails: Every field visit, every data entry and every ecological milestone is recorded and maintained for the constant improvement and transparency of the audit process.

- Alignment with the Clean Energy Regulator: From methodology to reporting format, Carbon Neutral mirrors the regulatory frameworks that underpin market confidence. Projects are designed with auditing in mind from day one.

Offsets Without Integrity Risk More Than Compliance

For Australia’s largest emitters, every carbon credit represents a convergence of risk and opportunity. The risks of engaging inadequate or non-compliant project developers are tangible:

- Reputational fallout from greenwashing accusations can erase years of ESG progress.

- Financial exposure arises when credits lose their value due to failed audits or regulatory changes.

- Investor distrust can surface if there is any suggestion that climate claims are not fully substantiated.

That’s why, at Carbon Neutral, audit readiness is not just a feature – it’s a promise. Each project track is crafted to not only satisfy current Clean Energy Regulator (CER) standards but also to anticipate an evolving policy and market landscape.

What Integrity Really Looks Like

Integrity is the unspoken contract between carbon project developers and those whose reputations and assets rest on their work. Carbon Neutral’s process strengthens this contract at every stage:

- Data systems built for scrutiny: Our constant improvements to monitoring tools and reporting platforms help us to meet – and exceed – auditor expectations.

- Proactive compliance: By aligning our methodologies with regulator and offset integrity standards, we reduce uncertainty for clients and safeguard against policy change.

- Risk mitigation beyond carbon: Our approach includes detailed permanence strategies and robust natural risk management, ensuring credits are resilient to both operational and environmental reversals.

This is more than simple compliance – it is market leadership in integrity.

Why Legacy Is the Strongest Climate Asset

Business leaders understand that legacy is not built on what is easy or expedient, but on what endures. Carbon projects, if done right, are far more than a purchase on a ledger; they are a lasting demonstration of corporate stewardship and vision.

Every tree measured, every hectare nurtured and every evidence trail maintained is a testament to credibility for all stakeholders – from shareholders to local communities.

Meeting the Demands of a Compliance-Driven Era

Australia’s compliance landscape is only tightening, with regulators, watchdogs and communities showing little patience for offsets with questionable provenance. High emitters face increasing expectation – from within and beyond their organisations – to back claims with rigor, transparency and auditable results.

Carbon Neutral welcomes this challenge. We invite scrutiny, build for it and thrive in it. Our field teams do more than plant trees; they cultivate trust, one data point and one report at a time. Every ACCU we help deliver is a promise: robust, defensible and ready to stand the test of regulation and public expectation.

For businesses seeking not just fleeting compliance but a climate legacy, project integrity is non-negotiable. At Carbon Neutral, this integrity is built in from the ground up – because in carbon markets, trust is the only currency that endures.

Explore stories in the world of sustainability, carbon and climate change.