Nature-Based Solutions: The Smartest Investment for Corporate Climate Action

Carbon Neutral

DateSeptember 2025

As global markets accelerate toward net-zero targets and nature-positive outcomes, investors are seeking solutions that deliver measurable climate impact while protecting biodiversity and strengthening communities. Nature-based solutions (NbS) — including reforestation, landscape restoration, and regenerative land management — are now recognised as one of the most effective and scalable investment strategies to meet these goals. At a time of increasing regulatory scrutiny and stakeholder expectations, nature-based solutions offer investors a unique opportunity to align financial performance with environmental and social value creation.

This includes both capital investment in revenue-generating nature projects—such as reforestation or carbon farming that deliver carbon and biodiversity credits—and direct support for critical conservation initiatives. For example, funding private sanctuaries like Carbon Neutral’s Perenjori Hills Sanctuary provides immediate impact by protecting threatened ecological communities while laying the foundation for longer-term biodiversity credit generation. Similarly, large-scale reforestation projects such as the Yarra Yarra Biodiversity Corridor demonstrate how integrated carbon and biodiversity credit models can deliver verified climate benefits alongside ecological restoration at scale.

Why Investors are Backing Nature-Based Solutions

According to the Intergovernmental Panel on Climate Change (IPCC), nature-based solutions could contribute up to 30% of the global emissions reductions needed by 2030 to stay within a 1.5°C warming pathway. In parallel, the World Economic Forum estimates that over $44 trillion in economic value — more than half of global GDP — is moderately or highly dependent on nature and its services.

For investors, the appeal is clear:

- Scalable deployment across geographies and landscapes

- High demand from both voluntary and compliance carbon markets

- Stacked co-benefits across climate, biodiversity, and community impact

- Risk mitigation by proactively addressing nature-related and supply chain risks

- Alignment with TNFD, SBTi, ISSB, and SDG frameworks

Corporate Demand is Driving Market Growth

Major corporations are embedding nature-based solutions into their climate strategies, creating strong forward demand for high-quality, nature-positive investments:

- Microsoft has pledged to be carbon negative by 2030 and is investing in afforestation and reforestation projects globally. In 2021 alone, it purchased over 1.4 million tonnes of carbon removal — much of it through nature-based solutions.

- Nestlé is investing in regenerative agriculture and forest conservation as part of its commitment to reach net zero by 2050. Its plans include planting 200 million trees by 2030.

- L’Oréal has established a €50 million Fund for Nature Regeneration, targeting projects that restore degraded habitats, sequester carbon, and support sustainable livelihoods — with an emphasis on inclusion and local community engagement.

These companies are not just offsetting emissions — they are investing in natural capital as a strategic asset.

Some are also directly sponsoring conservation action on the ground, recognising the importance of securing intact ecosystems alongside restoration. This blend of philanthropic and market-driven investment is increasingly seen as a holistic approach to climate and biodiversity goals.

Investment Confidence Through Standards, Verification, and Inclusive Partnerships

For institutional and impact investors, project credibility now demands more than verified carbon sequestration. Leading nature-based projects demonstrate integrity through robust certification, transparent governance, and inclusive community partnerships.

Best-practice nature-based solutions:

- Are independently certified under standards such as Gold Standard, Verified Carbon Standard (VCS), or Plan Vivo

- Comply with the principle of Free, Prior and Informed Consent (FPIC) in all engagements with First Nations and Indigenous communities

- Embed Traditional Ecological Knowledge (TEK) into restoration and land stewardship approaches

- Ensure Indigenous participation in project governance, monitoring, and benefit-sharing

- Create tangible economic and social outcomes, including employment, enterprise, and skills pathways

- Align with key UN Sustainable Development Goals

Investors increasingly view these elements as essential to long-term risk management, reputational resilience, and measurable ESG performance.

The Economics of Nature-Positive Investment

Nature-based solutions are not just environmentally impactful — they are financially attractive. Consider:

- The voluntary carbon market is projected to reach US$50 billion by 2030 (McKinsey).

- Nature-positive assets are increasingly targeted by sovereign wealth funds, blended finance vehicles, and ESG funds.

- Projects with verified biodiversity and social co-benefits command premium pricing in the carbon market.

- Nature-based projects offer investors a hedge against regulatory and biodiversity-related risks, while generating returns aligned with ESG mandates.

Aligning With Emerging Disclosure Standards

Expectations and regulatory frameworks evolve, nature-based investments help future-proof portfolios against shifting standards.

- The Taskforce on Nature-related Financial Disclosures (TNFD) encourages companies and investors to assess and disclose their nature-related risks and dependencies.

- The ISSB (International Sustainability Standards Board) is pushing toward global baseline sustainability disclosures, including those related to ecosystems.

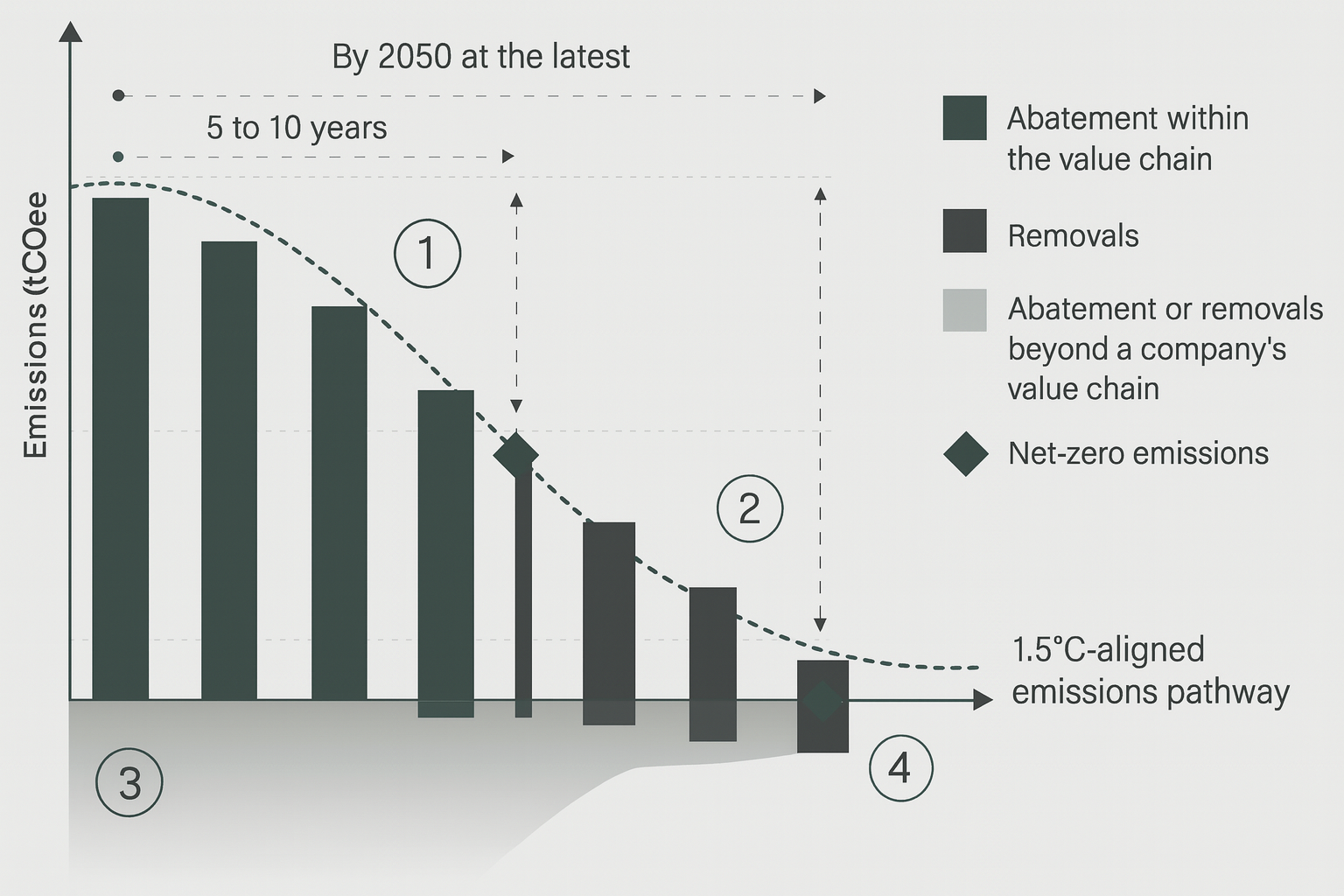

- The Science Based Targets initiative (SBTi) Net-Zero Standard emphasises the need to go beyond decarbonisation — toward nature-positive outcomes.

Nature-based investments provide a credible, transparent, and proactive response to these trends.

The Opportunity is Now, Rooted in Nature-Based Solutions

From Microsoft to L’Oréal, the world’s most forward-looking companies are not just buying credits — they are backing projects that restore ecosystems, strengthen community resilience, and deliver high-integrity climate action.

For investors, nature-based solutions represent a rare alignment of impact and return:

- An expanding market

- A growing policy tailwind

- A strong reputational upside

- And a chance to shape the future of sustainable finance

Whether through direct funding of conservation sanctuaries or capital investment in long-term credit-generating projects, supporting nature is no longer just philanthropy—it’s smart, future-facing strategy.

Interested in Nature-Based Solutions at scale?

Contact us to scale your impact.

Perenjori Hills Sanctuary

Located in the heart of the Yarra Yarra Biodiversity Corridor, the Perenjori Hills Sanctuary supports rare and threatened species, ancient plant communities, and delicate ecosystems increasingly impacted by habitat loss, invasive species and climate stress. As part of Australia’s largest carbon-based reforestation initiative, its conservation is guided by Carbon Neutral’s Citizen Science program—bringing people closer to nature through hands-on ecological exploration and monitoring.

Explore stories in the world of sustainability, carbon and climate change.