Make 2023 your year of ESG

Michael Cooper

DateFebruary 2023

7 Reasons to undertake an ESG report in 2023

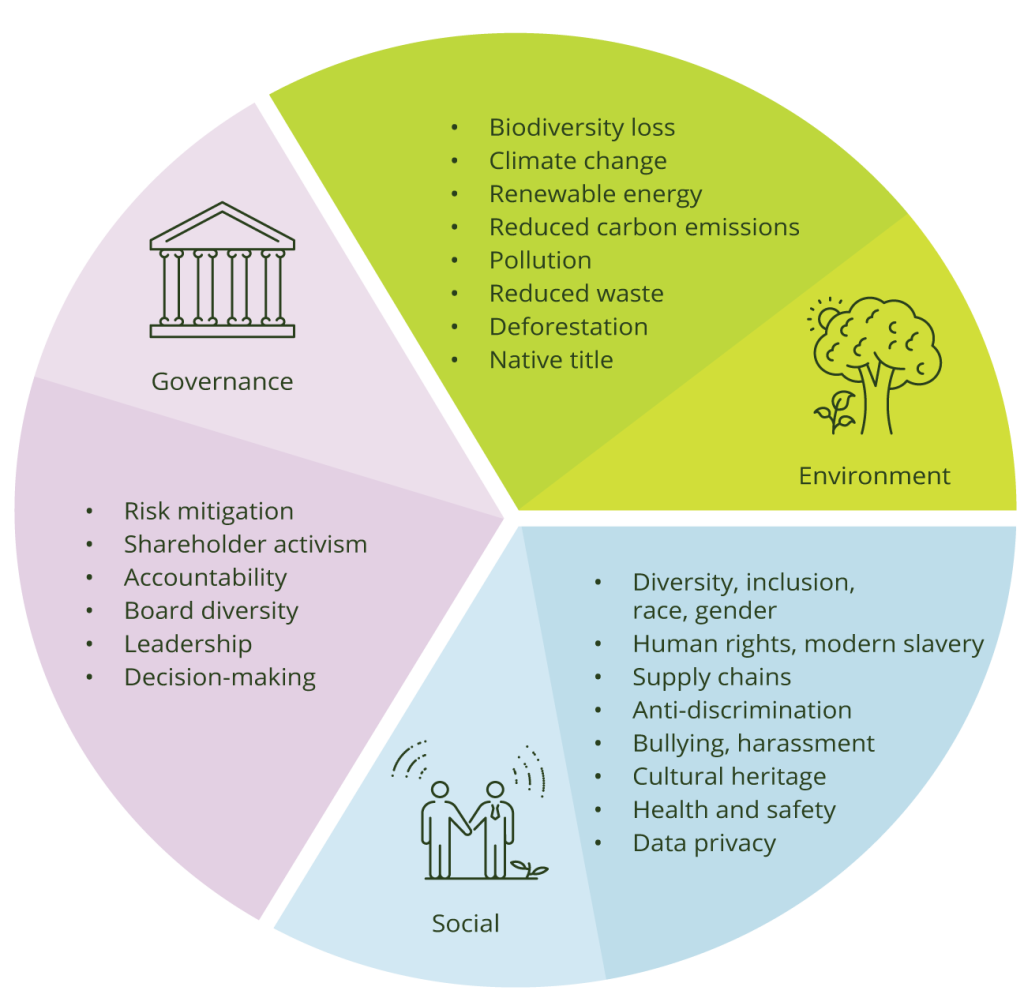

Instances of businesses undertaking Environmental, Social and Governance (ESG) reporting have grown exponentially over the last five years, and the trend will undoubtably continue as we move through 2023. For medium to large organisations, the question is no longer should we begin the ESG journey, but rather when and how do we begin.

Business leaders across the globe are learning the benefits and now understand the key reasons to measure and report the effects that their organisational operations have on the planet, community, and society as a whole.

In Australia in particular, regulators are looking more closely at business’ ESG credentials and related risks. This is dovetailed with moves to align markets with sustainability goals through widespread discernible regulations and standards.

As data driven, net-zero targets become the norm, Scope 3 emissions are now being documented and reported upon more than ever before. Furthermore, the conversations around greenhouse gas emissions and climate change have now broadened to a much greater understanding of critical damage being done to biodiversity throughout the planet.

It is now a simple fact of the global economy that stakeholders require the type of data obtained through ESG reporting to inform decisions on which companies to invest in. Moreover, regulatory bodies use these reports to ascertain investment risk assessments, and businesses who hope to win contracts with governments or publicly listed businesses, increasingly are required to disclose ESG performance data.

In the simplest of terms, ESG is now crucial because the world has finite resources. The modern world also requires significant societal change to remain sustainable in the areas of gender equity, economic disparity, and social and cultural unrest. These are the key issues that ESG reporting looks to address and the advantages that undertaking a report can provide.

1. Investor expectation

An overwhelming amount of research and evidence now proves that investors want to know where your company stands on ESG issues, and how you intend to mitigate against issues discovered during the ESG process. If you can’t provide a roadmap to corporate sustainability, it is becoming increasingly difficult to draw long-term and sizeable investment.

2. Reputational insurance

A professional ESG report will greatly help your business’s public perception and marketing push. Consumers now demand to know a brand’s sustainability credentials right across the products and services that they provide. An ESG report will provide a clear understanding of exactly what your company is doing and intends to do in this domain.

Businesses that don’t fully understand their own environmental, social and governance impacts may unwittingly breach laws or ethical standards, and ultimately find themselves in the midst of damaging PR situations.

If you don’t have an ESG report, it is impossible to genuinely describe your position on a range of issues. The only way to avoid this is to have an ESG report ready to deliver and respond to when worst case scenarios arrive.

Providing clear and concise information about your ESG efforts can also be an effective way to protect against any future litigation. If your business is transparent, it is more difficult for groups to begin lawsuits against your organisation. Similarly, data uncovered in ESG reports often plays a key role in business’ SWOT analyses and annual corporate strategies.

3. One shared planet

Describing your environmental endeavours will allow your business to be seen in the best possible light. An ESG report will outline the steps that you are taking to protect the planet and it’s diminishing resources. Failure to have an ESG report and informed strategy will lead to potentially false assumptions about the way in which your business operates.

4. Looking after all your stakeholders

All businesses have an impact on the individuals who work for them, the clients they serve and the wider communities around them. It is becoming increasingly essential to provide information on how each of these stakeholders are handled and kept up to date with evolving information.

An ESG report will give you the chance to present this information in a digestible and transparent manner.

5. Staff Fulfillment

Establishing an ESG report can help you not only to determine that you’re taking positive steps forward, but also how you promote your credentials to existing or potential members of staff. If you fail to provide an ESG report, it isn’t truly possible to fully articulate this to your workforce – and this is often a key factor in individuals electing to choose on position over another.

6. Market your credentials

All modern businesses are examining ways to engage their clients and audiences. An ESG report can be an invaluable marketing tool in demonstrating that you are taking positive steps forward. A recent study by Forbes showed that 82% of millennials said they wouldn’t purchase products or services from brands that did not take part in positive social initiatives, and an ESG report is the most effective way and describing your efforts in this domain.

7. Compliance is king

It is now vitally important to be able to articulate that your business follows the ever-evolving laws that apply to ESG. Depending on the size and type of your business, there are currently a wide range of reporting requirements in ESG including:

- Environmental – The National Greenhouse and Energy Reporting Act of 2007, under conditions to Commonwealth and State environmental and planning approvals and under the Climate Change Act 2022.

- Social – Employees’ rights under Commonwealth and State industrial relations and work health and safety legislation; various discrimination and equal opportunity laws and modern slavery reporting under the Modern Slavery Act 2018 and the NSW equivalent for state-owned corporations.

- Governance –The ASX Listing Rules, pursuant to the ASX Corporate Governance Principles and Recommendations, as well as disclosure obligations for directors and financial reporting obligations under common law.

To maintain a direction that keeps your business ahead of the curve, consideration should also be made of voluntary ESG disclosures including:

- Global Reporting Initiative (GRI) Standards

- Sustainability Accounting Standards Board (SASB) Standards

- United Nations Principles for Responsible Investing (PRI)

- CDP Global

- Global ESG Disclosure Standards for Investment Products

An ESG professional can guide you and your business through taking the most effective steps towards each of these areas.

ESG Reporting

ESG reporting is just one of several assessment types provided by Carbon Neutral’s team of professionals. Contact us to learn what steps your business should take in 2023.

Explore stories in the world of sustainability, carbon and climate change.